How to Create an Effective Personal Budget

Introduction to Budgeting

Creating a personal budget is a fundamental step towards achieving financial stability and freedom. A well-crafted budget helps you manage your income and expenses effectively, ensuring you live within your means and save for future goals. Whether you're new to budgeting or looking to refine your existing plan, this guide will walk you through the process of creating an effective personal budget. Let's dive in and explore the key steps to successful budgeting.

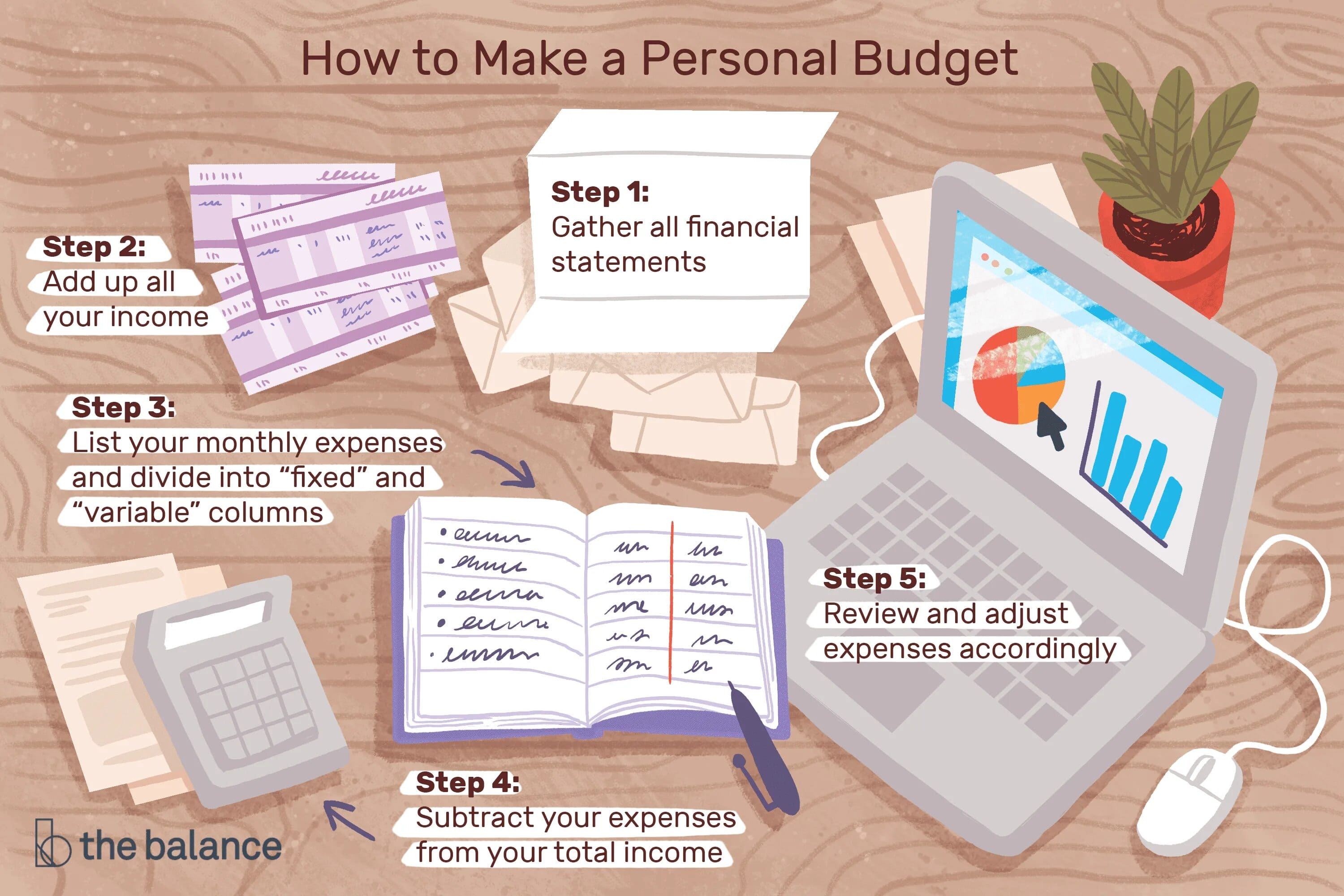

Steps to Create an Effective Personal Budget

-

Calculate Your Income

The first step in creating a budget is to calculate your total income. Include all sources of income, such as your salary, freelance earnings, rental income, and any other regular income streams. Make sure to account for both gross and net income to get an accurate picture of your financial situation.

-

List Your Expenses

Next, list all your expenses. Categorize them into fixed expenses (e.g., rent, mortgage, utilities) and variable expenses (e.g., groceries, entertainment, dining out). Be thorough and include even small expenses, as they can add up quickly. Use bank statements, receipts, and bills to ensure accuracy.

-

Set Financial Goals

Setting financial goals is crucial for creating an effective budget. Determine what you want to achieve with your money, whether it's saving for a vacation, paying off debt, or building an emergency fund. Having clear goals will help you prioritize your spending and saving.

-

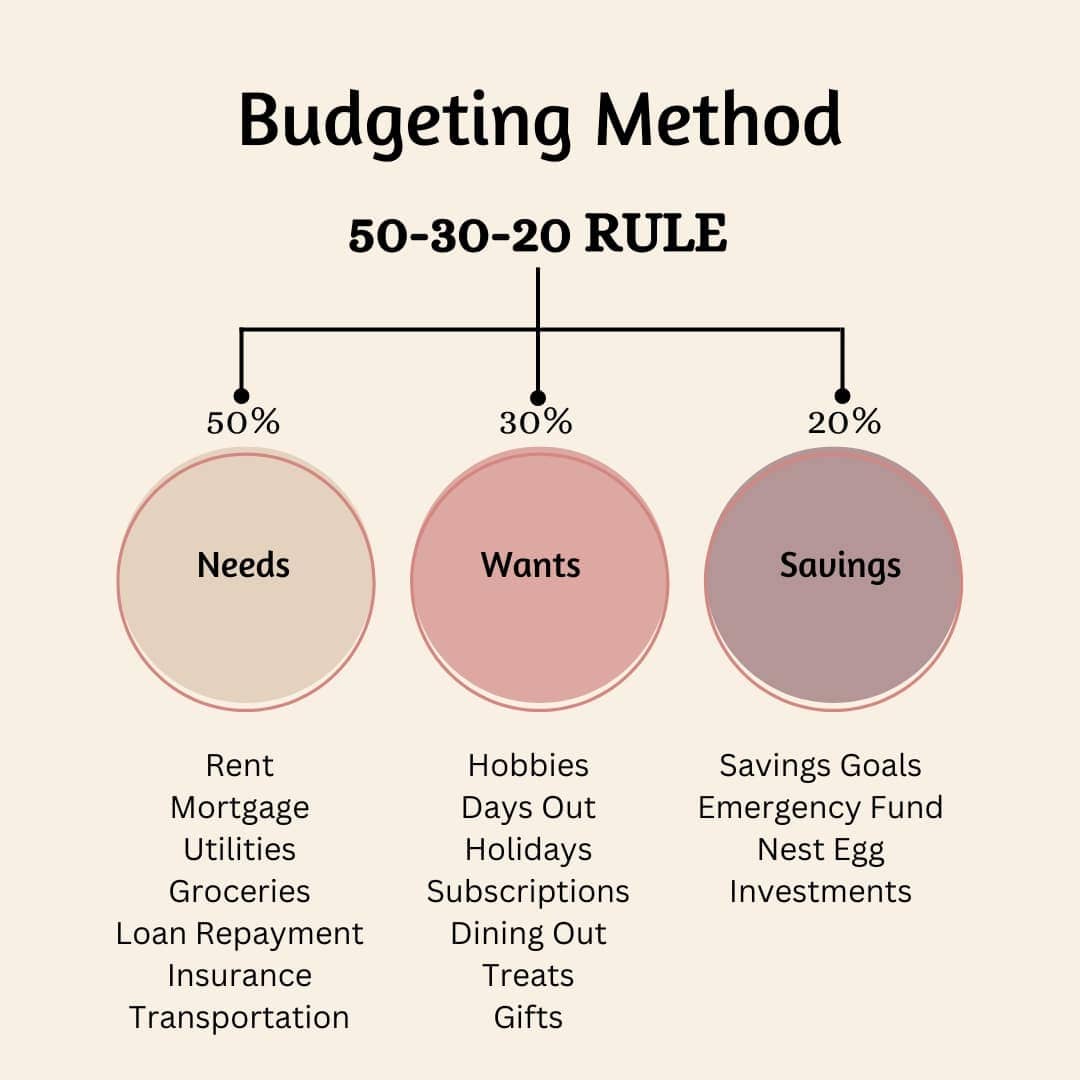

Allocate Funds

Based on your income and expenses, allocate funds to different categories. Ensure that your essential expenses are covered first, followed by savings and discretionary spending. Use the 50/30/20 rule as a guideline: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

-

Track Your Spending

Regularly track your spending to ensure you're sticking to your budget. Use budgeting apps, spreadsheets, or even a simple notebook to record your expenses. Review your spending patterns and make adjustments as needed to stay on track.

-

Review and Adjust

Budgeting is an ongoing process. Review your budget regularly to assess your progress and make necessary adjustments. Life circumstances and financial goals can change, so be flexible and willing to adapt your budget accordingly.

Tips for Successful Budgeting

-

Be Realistic

Set realistic goals and expectations for your budget. Avoid being overly ambitious, as this can lead to frustration and failure. Start with small, achievable goals and gradually work towards bigger financial milestones.

-

Prioritize Savings

Make saving a priority in your budget. Aim to save at least 20% of your income for future goals, emergencies, and investments. Automate your savings by setting up regular transfers to a savings account to ensure consistency.

-

Avoid Impulse Spending

Impulse spending can derail your budget. Before making a purchase, ask yourself if it's a need or a want. If it's a want, consider waiting for a few days to see if you still desire the item. This can help you make more mindful spending decisions.

-

Use Cash for Discretionary Spending

Using cash for discretionary spending can help you stay within your budget. Withdraw a set amount of cash for the week and use it for non-essential expenses like dining out or entertainment. Once the cash is gone, avoid using credit cards to prevent overspending.

-

Seek Support

Don't hesitate to seek support from financial advisors, budgeting apps, or online communities. Having a support system can provide motivation, accountability, and valuable insights to help you stay on track with your budgeting goals.

Conclusion

Creating an effective personal budget is a crucial step towards achieving financial stability and freedom. By following the steps and tips outlined in this guide, you'll be well on your way to managing your money effectively and reaching your financial goals. Remember, budgeting is an ongoing process that requires patience, discipline, and flexibility. Embrace the journey, and enjoy the peace of mind and financial security that comes with successful budgeting. Good luck!